Spice DAO bought a copy of Dune for around 100 times what it was actually worth. I covered that in an earlier article – but what is a DAO?

Take a DAO

DAO stands for Decentralized Autonomous Organization, which is sort of vague. Right now, every DAO does things a little differently, and determines their leadership in different ways. In theory, DAOs can range from totally democratic to monarch to parliament, split system decision-making based on how they determine power. Critical to their existence, though, is cryptocurrency. If a DAO is running off of real, regulated money, it’s not a DAO (because of the ‘decentralized’ part of the name) – it’s an investment firm. Or a club.

DAOs come together for all sorts of reasons, but one thing’s for sure – they’re colored by the space they’re in. Some sites claim they formed as a way to destroy hedge funds, and undercut investment firms, while others say they simply want to be those firms or funds without all of the red tape and societal hatred they’ve earned themselves in the years after the financial crisis in the US. They do, at least, almost always say they want to be better than the old guard, a more fair and equal place – but issues begin springing up almost immediately when you reckon with the how.

Voting Techniques

DAOs don’t exist just to exist, they do stuff. They buy stuff. They make projects. They do a lot of the stuff that ordinary startups and businesses do, but they do it outside of the constraints of things like tax laws and labor rules (which is a whole other story about ethics – and other people have explained it better than I ever could). Voting systems vary, but most are software enforced and somehow recorded on the blockchain. Why be a DAO if you don’t use blockchain, after all?

DAOs work by pooling resources together, whether that be crypto bucks, expertise in coding or other relevant fields, or other outside factors like purchased tokens that don’t translate directly into % of ownership like investment money would. They then form an autonomous organization, something that’s not quite a business, kind-of sort-of an investment firm, but no matter what you call them, they’re prone to high-risk behavior. Because crypto itself is prone to wild fluctuations (even Bitcoin, one of the oldest, has dropped double-digit percentages in the past two weeks) the vibe for investments and decision-making is now. Do it now, because you might not have the money to do it later. Systems that don’t do democratic-style decision making are even more prone – there’s a kind of leader who’s not afraid to burn other people’s money just because they can, and unfortunately the unregulated space of crypto stuff right now is incredibly attractive to that kind of people.

Not every DAO is like that, but right now there’s no safeguards within the ones that are. Other DAOs have methods that feel more fair on the surface, but may fall apart when looked at outside of a vacuum.

For example, some DAOs work by counting held tokens as votes. Person A has 20 tokens, person B has 10 – person A is going to win the vote unless person B puts some serious efforts into lobbying other members into voting for what they’re suggesting.

This has serious flaws! In the crypto space, some people are so eager to ‘get in on the ground floor’ that they’re willing to take a pittance for supplying critical coding or expertise, for example. The difference between person A and person B might be more like 200 tokens vs. 1. Or half a token, or less.

So that doesn’t always work out. It turns into an oligopoly, and person B doesn’t feel represented. Person B may actually be most people in the DAO, but Person A just has so much money, their word goes no matter what.

The next technique seems more fair on the surface – everyone still pools the resources they want to pool, but each and every individual gets one, individual vote. However, the problem now is getting person A to agree to this system. Most DAOs have at least one ‘whale’ member, someone who was already independently wealthy and is for some reason or another looking to put that money into an organization. Power, owning something rare, or getting even more money are all relevant wants when someone wants to start or join a DAO, and the grassroots, ‘everyone’s-equal’ picture crypto enthusiasts try to paint doesn’t align with that reality. We’re watching a sturdier institution fold under the pressure of money right now, the thought that removing more of the safeguards that had kept it upright til the eighties would somehow fix that problem is foolish. At the heart of the DAO is not anarcho-capitalism, its feudalism, again. It’s feudalism hiding behind cool, illegible technology with whale users sucking in other members with the promise they can be a courtesan and not a field worker if they come to their land.

The third option also seems like a solution for the first option’s problems on the surface, only to also be a problem: burning the tokens to vote. If person A has 20 tokens and is only willing to burn 10 on the vote, Person B can burn all of their tokens and vote, and tie it up – they won’t have to lobby as hard to get enough votes to win. However, If B is not actively accumulating tokens and A is, then they haven’t actually solved the problem, they’ve just delayed it to the next decision where B has only enough money to buy one token at the market price while A still has 10 to use. Burning the tokens to vote discourages participation, anyway. If a DAO wants to claim fairness because every member can vote, this system is incongruent with that.

Every voting system has its problems. DAOs are just the worst expression of all of them, one where money directly contributes to how decisions about that money are made.

If they decide to use voting at all. It’s common, yes, because it attracts small fish with a sense of fairness and equity, but it’s not the only way DAOs form or make decisions.

DAO Rules

DAOs can be anything, and that anything means that they can stack themselves up however they like – if they want to have a board determined by people with one of 9 Very Important Tokens, they can! Unfortunately a lack of foresight infrastructure, blockchain enforcement of votes, and powerful software means that if one of those token holders goes missing, there’s no way to retrieve it from them. Depending on the DAO’s coding, it might not be possible to vote without it at all – if all members are mandated to respond in a system with no undo or back button, then they’re just… stuck there. This forces the rest of the DAO to make the decisions outside of the DAO, which is not good for anyone not on that board due to a lack of transparency, and ultimately destroys its original purpose.

Cryptocurrency is cool, but working with it is like carving into stone. People are already pointing out the obvious flaws of being able to mark a person permanently (This video by Davin Brown does a tremendous job at highlighting all of the issues with such a system, including union-busting, snubbing people who’ve donated to specific organizations, and doxing: https://www.youtube.com/watch?v=YQ_xWvX1n9g) and this is just one more to add to the pile.

The Source Of The Issues

Silicon Valley has a serious problem with chasing out ‘others’, even as much as it promises it doesn’t, in the same way premeditated murder still happens even though it’s illegal. This is not ideal. If someone in Troy’s leadership had been a craftsman, and knew the horse was waaay too light for the amount of wood it was supposedly made of, that horse – and the invading force – wouldn’t have made it inside. Getting new perspectives from outsiders to the industry is what makes some of the most successful businesses what they are! It’s not impossible for a DAO made up of crypto to do something new, but it’s significantly more likely they do something like spend too much on a concept book for Dune.

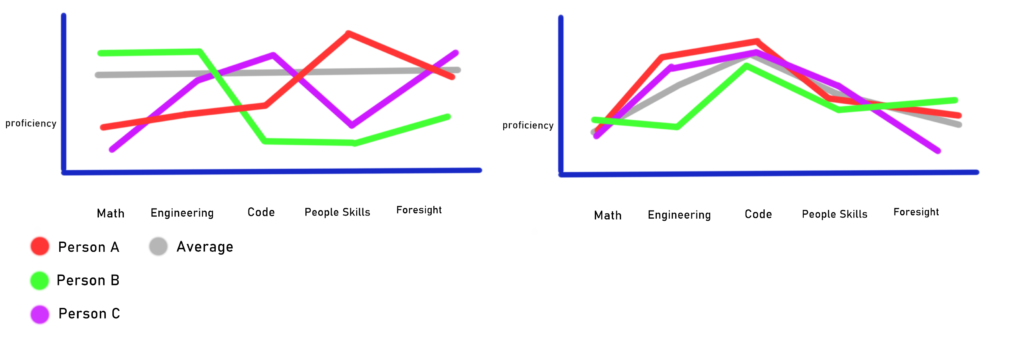

The benefits of working as a group come from levelling out every individuals’ peaks and valleys to make one being, one company, one organization, that’s perfectly average and not deficient in anything. To do that, the peaks and valleys of each contributor have to be in different spots.

In hyper-bro spaces like Crypto is and DAOs are right now, this is not going to happen to the extent it would need to. Again, even if Spice DAO knew they weren’t buying permissions for Dune, they spent literally 2 million pounds too much on it just to own the concept book. They overpaid severely. That wasn’t a sound decision even if they knew, fully, what they were doing. What was likely meant to be a ‘flex’ of how much money they raised instead turned them into an easy target for online scorn. Believe it or not, not all publicity is good publicity, especially when people are using you specifically to highlight all of the flaws of the product you’re working within. The people drawn to NFTs are the same people who spend money to show off, so without dissenting voices, stuff like this is going to continue to happen and lessen any legitimacy they might have.

As J.D. Powell put it when he started his company, the upper executives wanted things to be what they were not, and would demand that reality bent to what they wanted. We collectively know now that that’s not a productive way to do things, but for a bunch of engineers and beginning entrepreneurs, alongside wealthy investors, the odds that they’re going to have to re-learn this lesson the hard way are nonzero. Heck, even well-established businesses take their own crash-courses sometimes!

Sources: